Alternative Lending Solutions

Need an immediate financing option for your farm operation? With Private Capital Investor’s alternative lending solutions, you are one step away from receiving seamless financial aid for your agribusiness.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Alternative Mortgage Financing for Agriculture Lands

Farming professionals who cannot qualify for traditional loans due to property conditions, credit scores, income sources, etc., can opt for alternative mortgage financing.

At Private Capital Investors, we understand your need to borrow and offer mortgage loans to meet your financial requirements.

Alternative mortgage financing provides flexible and innovative solutions for acquiring, expanding, or improving agricultural lands.

Unlike conventional lenders, alternative lenders understand the intricacies of farming and offer customized mortgage options that align with the dynamic nature of agricultural operations.

Amortization: 30 years amortization with no prepayment penalties

Loan Amount: $3 Millions to $50 Million

Min Credit Score: 680

Closing in as little as 2 weeks

Maximum LTV: Upto 70% Loan to Value

Adjustable and Fexible rates are available

Nationwide Lending

Eligible Transaction Types

Opportunity purchases

Quick closings

Full-time agricultural activities

Part-time agricultural activities

Purchase new farms

Expand existing farm land

Traditional acquisitions

Invest in such recreational activities as fishing,

Short Lines of Credit

Eligible Land or Farm Loans Types

Alternate Ag Loans

Hobby Farm Loans

Cattle Loans

Orchard Loans

Poultry Farm Loans

Cirtrus Loans

Vacant Land

Rural Land

Agriculture Operation loan

Why choose Private

Capital Investors?

Our alternative mortgage financing offers flexible payment options to make loan repayment more straightforward and hassle-free.

We understand that every borrower, whether a rancher or farmer, has different financial needs, so our products are tailored to meet those requirements.

We can help you acquire agricultural financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Min. Credit Score: 680

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Christian College

San Diego | $13,000,000

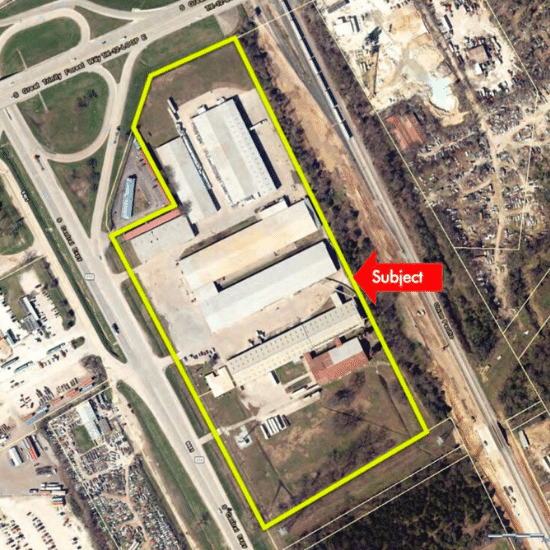

Light Industrial Warehouse

Dallas TX | $7,500,000

Office/Industrial

Leander TX | $7,200,000

Different Types of Alternative Mortgage Financing?

Our alternative lending solutions include the following types of loans:

Hard Money Loans

We have lent hard money loans to help businesses since 2001. Our funding procedure is quick and seamless as we are a full-service direct commercial lender for hard money. So, you can rest assured of fund allocation within two weeks.

Bridge Financing

Rely on us for seamless cash flow with bridge loans or mortgage options during hard times. Conveniently, you can repay the borrowed amount within 1 to 3 years.

Agriculture Financing Requirements

Traditional mortgage financing for agricultural lands often comes with challenges, such as rigid terms and lengthy approval processes.

However, alternative mortgage financing offers a fresh approach tailored specifically to the unique needs of farmers and landowners.

Contact Us to Learn more about Alternative Lending Solutions.

Do you have more questions about our alternative lending solutions?

Feel free to contact our experts at info@privateinvestors.com or call 972-865-6206.

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com