Commercial Real Estate

Bridge Loan Financing

Commercial real estate bridge loans are a financial tool for CRE investors who need more money upfront but don’t have permanent financing yet. We being the direct lender help you get the loan within 14 days.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Commercial Bridge Loans

The ‘bridge’ name comes from how these instruments can help smooth out cash flow during difficult times by providing quick access to liquidity without having any serious consequences.

Bridge loans are widely used for repositioning, value-add, or rehabilitation opportunities. It’s important to secure this financing from trusted commercial real estate bridge loan lenders so you can get the best rates and terms.

Commercial real estate bridge loans can help investors prevent liquidity issues. They are perfect for vacant buildings, special purpose properties and major rehabs. Private Capital Investors, being a direct commercial real estate bridge loan lenders can allocate funds quick and fast.

Loan upto $50 million

Loan term ranging from 1 to 3 years

1.25 at exit with appropriate in-place DSCR

Maximum LTV: 85%

Interest Rate as low as 5.99%

first mortgage lien on the subject property as securtiy

Tax & Insurance Escrows: monthly

Replacement Reserves: monthly

Eligible Transaction Types

Opportunity purchases

Quick closings

Non-stabilized properties

Foreign nationals

Non-cash flowing properties

Foreclosure purchases

Traditional acquisitions

Acquisitions with rehab component

Acquisitions with completed new construction

Debt buy-backs with fresh equity

Properties in lease-up in strong markets

Eligible Property Types

Multi-Family

Office

Retail

Luxury Residential

Urban Land

Self-Storage

Light Industrial

Hospitality

Development

Mixed-use property

Why choose Private

Capital Investors?

We are one of the trusted direct commercial real estate bridge loan lenders. Our team of experienced CRE professionals will analyze your financing needs, so you can make informed choices. We can help you acquire bridge financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Rates as low as 5.99%

Nationwide Lending

24 – 48 Hours Approvals

Funding as little as 14 days

Stated Incomes, No Financials required

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

Office/Industrial

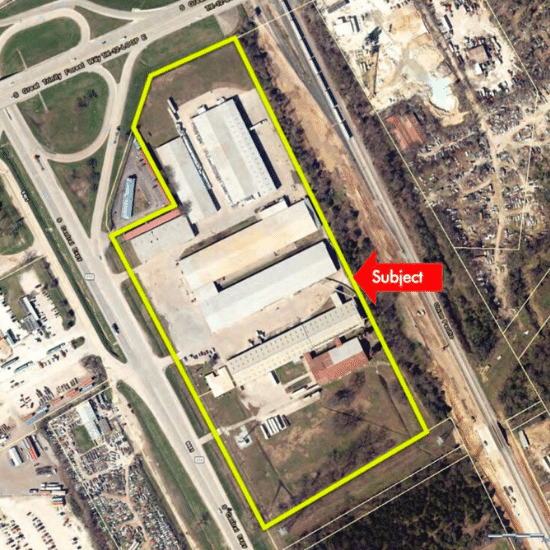

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Frequently Asked Questions

Are commercial bridge loans good for long-term financing?

No. Commercial real estate bridge loans are suitable for temporary financing requirements. They typically last for 12 to 36 months. When in doubt, contact us and our mortgage loan consultants will help you understand if this type of financing is appropriate for your case. Otherwise, we can recommend other sources of funding that will fit your unique situation.

What are the interest rates on CRE bridge loans?

A bridge loan typically comes with lower interest rates than a commercial hard money loan but is still more expensive than a bank loan. It may be ideal for you if you cannot secure funds from traditional lenders at the moment, or if you simply require a short-term loan.

Is bridge financing the same as a hard money loan?

No. Both are asset-based, which means that the loan is largely influenced by the collateral. However, bridge loans are approved faster.

Will I qualify, even with not-so-good credit?

Even if your credit is not perfect, our team will walk you through the process and guide you to the best commercial real estate bridge loan program that suits your needs. Contact us to get started!

Why You Need Commercial Real Estate Bridge Loan?

Commercial Real Estate Bridge Loan

The bridge loan helps bridge the gap between the short-term need for financing and the long-term goals. It helps investors get a large amount of money when they need it right away while they wait to receive capital from the property sale.

It is similar to hard money loans, so they are measured mainly by the collateral offered. The bridge loan is the fastest loan to get approval. The speedy nature makes it easy for investors to get work approval.

Herein the interest rate can be pretty high, but the fast processing makes it an attractive solution for investors looking for funding fast.

Benefits of Bridge Loan

A significant benefit of the Bridge loan is that you will not miss the deal presented to you when you don’t have the required funding. In addition, the Bridge loan help carry the cost until you can sell or secure a better investment option.

Process of Bridge loan funding

Bridge loans are a medium for investors to get the required funding without difficulty.

The borrowers can use the property’s equity to pay for the down payment of the purchase of the new property while they wait for the sale proceeds from the current property.

The lender herein will provide the loan to the borrowers with excellent credit and low DTI ratios.

A person can get a mortgage for two properties together, which offers tremendous flexibility.

However, in most cases, the lender will provide the bridge loan on a specific percentage of the combined value of the properties. This means the borrower needs sufficient equity in the original property savings to pay for the rest.

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com