Stated Income Commercial Loan

Your direct stated income loan lender for Commercial Real Estate.

No tax return & No W-2’s required. Get an easy low document loan

in the shortest period of time.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Commercial Stated

Income Loans

One of the most popular options in commercial real estate financing is the stated income loan, which is generally easier to obtain than traditional financing. That’s because stated income commercial lenders do not require tax returns and W-2s.

You probably already know that banks strictly require a long list of documents and proofs of income when investment properties are involved. This is why many CRE investors who can’t produce supporting documentation are unable to qualify for bank loans.

Loan Amounts range $1 Million to $50 Million

Minimum Credit Score 650+

No Tax Returns

No W-2’s

Easy Qualify

No Checking Account Statements Needed

Eligible Commercial Properties:

Multi-Family

Office

Retail

Luxury Residential

Urban Land

Light Industrial

Self-Storage

Eligible Commercial Transactions:

Property Improvements

Working Capital

Refinancing

Debt Consolidation.

Why choose Private

Capital Investors?

We offer a wide range of loan options, including commercial stated income loans. We are verified direct lenders and have the power to provide you with flexible loan terms. Our commercial mortgage loan team works closely with you to understand the pros and cons of commercial real estate property based on your unique situation and suggest the best CRE loan options that suit your needs.

Private Capital Investors is an established and well-known commercial real estate direct loan lender in the commercial real estate industry. We have a large number of private stated income commercial lenders in Dallas, Houston, Denver, Massachusetts, Miami, Phoenix, and Florida.

Rates as low as 5.99%

Nationwide Lending

24 – 48 Hours Approvals

Funding as little as 14 days

Stated Incomes, No Financials required

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

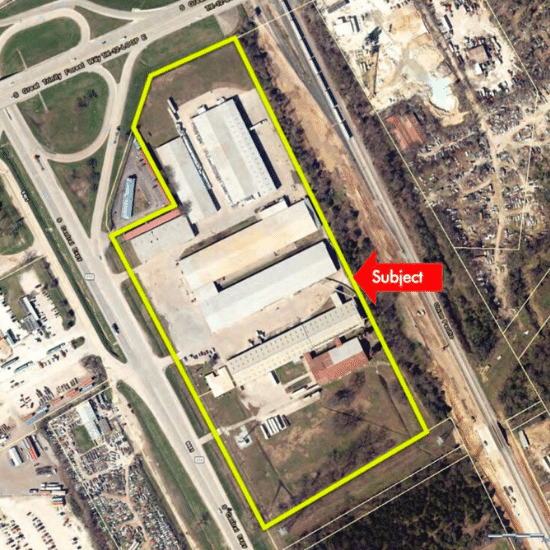

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Frequently Asked Questions

Will I be required to show my tax returns?

No. You don’t even have to worry about your debt-to-income ratio being reviewed.

I filed for bankruptcy a while back. Will I still qualify?

As long as your bankruptcy was at least 2 years ago, it shouldn’t be a cause for concern.

What if my credit isn’t perfect?

Our commercial stated income loans will still make you qualify with a mid-score of as low as 650.

How much can I get?

We are the direct CRE lenders that can lend anywhere from $1 million to $50 million.

Qualifying for a stated income loan shouldn’t be complicated. To learn more, don’t hesitate to get in touch with us! We offer a no-obligation mini-application to help you understand the process.

Why do You Need a Stated Income Loan?

What is Stated Income Loan?

A stated income loan allows self-employed investors to get the required amount of funding just by stating the monthly income on the mortgage application instead of the actual amount that needs to be presented through the tax returns.

It is a simplified version of getting a loan fast. In addition, they are a business or home loans that do not require any documentation or income verification for the self-employed borrower.

This is a significant benefit because the self-employed individual need not have to present proof of income before taking the loan.

What are the Benefits of Stated Income Loan?

The stated income loans are the best fit for those self-employed individuals who need to obtain funding to keep the business running. Multiple benefits and reasons make the loan quite a popular choice among business owners.

The most essential is the lower amount of paperwork required for the application process, which makes it hassle-free.

Besides, the payment sourcing here can be easier and faster. Lastly is the Debt-to-Income ratio of the loan, which does not happen to be a deciding factor for underwriting guidelines.

Process of Stated Income Loan Funding

When applying for a stated income loan, one needs to be prepared with all the essentials. Most are to have proof of at least two years of self-appointment. There is no requirement to prove liability or any other income source.

However, you need to show your bank statement for the last two months, proof showing that your business is still operating, and your business license.

The loan process can be hassle-free and quick. But to qualify for this loan, the borrower needs to have a large amount in the savings account, and the credit score must be higher than 700.

Given the benefits and ease of getting the loan, self-employed people can benefit significantly from it as they would be able to keep the business afloat without any difficulty.

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com