Land Loans

The first step in exploring the world of real estate development or farming is frequently obtaining a land loan. Specialized financing options known as land loans are intended to make the acquisition of undeveloped land easier.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Loan to Buy Land

Knowing the nuances of land loans can help you navigate the process effectively, whether you’re trying to start a new building/construction on land or grow your agricultural business.

For investors looking to purchase land for personal use or a variety of development projects, a land loan is an essential tool.

In contrast to property loans, loans for the acquisition of land have distinct down payment and appraisal criteria because land transactions are special.

100 Percent Financing Land Loans

Land loans with 100% financing are a good choice for people looking for complete finance because they do not require a down payment.

For eligible buyers with strong financial positions, this kind of financing can be especially helpful as it allows them to utilize their capital in other ways strategically.

Prospective borrowers must familiarize themselves with the various forms of land loan lenders.

There are several options available, ranging from specialized land loan lenders that offer conditions that are more closely aligned with the borrower’s demands to commercial banks and credit unions.

Land Loans for Bad Credit

Although it can be difficult, getting a land loan with bad credit, is still doable.

Since a borrower’s credit history may need to represent their current financial situation or the potential of their land development project, some lenders offer flexible terms.

Loans for Raw Land

The perceived risks associated with acquiring raw or undeveloped land can make the process more complicated.

Loans for raw land must be thoroughly evaluated in order to determine the land’s potential and the borrower’s goals, which can have a big impact on the loan conditions.

Amortization: 30 years amortization with no prepayment penalties

Loan Amount: $3 Millions to $50 Million

Min Credit Score: 680

Closing in as little as 2 weeks

Maximum LTV: Upto 70% Loan to Value

Adjustable and Fexible rates are available

Nationwide Lending

Eligible Transaction Types

Opportunity purchases

Quick closings

Full-time agricultural activities

Part-time agricultural activities

Purchase new farms

Expand existing farm land

Traditional acquisitions

Invest in such recreational activities as fishing,

Short Lines of Credit

Eligible Land or Farm Loans Types

Alternate Ag Loans

Hobby Farm Loans

Cattle Loans

Orchard Loans

Poultry Farm Loans

Cirtrus Loans

Vacant Land

Rural Land

Agriculture Operation loan

Contact Us to Know More About Land Loans

Please get in touch with Private Capital Investors if you’re thinking about buying land and want more details about your financing possibilities. Our specialists are available to provide you guidance on different kinds of land loans and select the one that best suits the requirements of your project.

Get in touch with us right now to find out how, with the correct funding, you can realize your dream.

We can help you acquire land financing in different cities and states.

Our Land loans offers:

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Min. Credit Score: 680

Excellent Customer Service

Common Sense Underwriting

Agriculture Loans

Farm Loans

Land Construction Loans

Land Equity Loans

Ranch Loans

Rural Land Loans

Vacant Land Loans

Land Loan Refinance

We Serve Nationwide

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

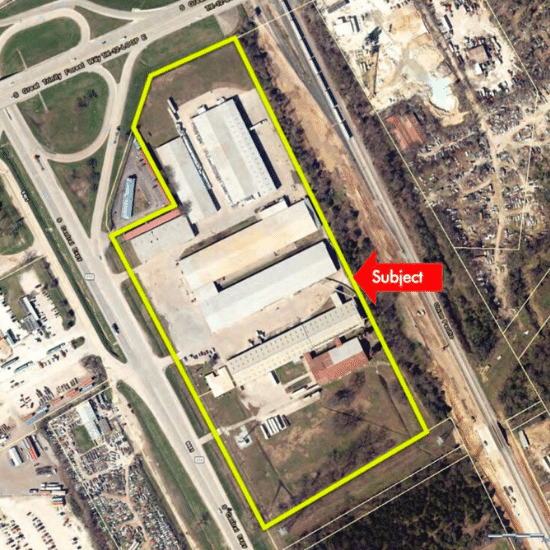

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com