1500+

Loans

1500+

Clients

1500+

Funded Loans

Types of Land Loan in Colorado

Raw Land Loans

Regarding land loans, raw land is thought to provide the most risk. No roads, utilities, power, or plumbing exist on this undeveloped piece of land. Make sure that before you approach a lender, you have a solid plan in place. Additionally, a sizable down payment will be required.

Unimproved Land Loans

Compared to raw landscape, unimproved property contains a few more developments, such as older road access or infrastructure. Water and power still need to be made available. Though they are still far better suited to property development than raw land, these areas are called undeveloped land areas. You will also require a minimum down payment of 25% and an excellent credit score.

Improved Land Loans

Improved land loans are prepared for development right away. They have far less risk to investors. Improved land has the necessary services and infrastructure.

Lender risk is reduced because upgraded land has far lower construction costs. The 15% minimum down payment reflects this.

Contact us to learn more about land loans in Colorado.

Please call us if you have any questions about loans in Colorado or would like to speak with a Land Loan Specialist over the phone. We will be happy to assist you with your needs.

Get In Touch

Our Loan Programs

Agricultural Land Loans

Our loans help farmers purchase land and create successful, thriving farming businesses.

Land Loans

Land loans offer specialized financing to simplify the purchase of undeveloped land.

Commercial Bridge Loan

Bridge loans are vital for CRE investors needing upfront capital without permanent financing. Get yours in 14 days!

Farm Credit Loans

Farm Credit Loans for land boost productivity, profitability, and ensure long-term farm success.

Commercial Stated Income Loan

Get low-document commercial real estate loans fast with no tax returns or W-2s required.

Commercial Hard Money Loan

We offers fast hard money loans for commercial properties ($1M to $50M) with rapid approvals.

Why choose Private

Capital Investors?

We understand that farming can be a challenging and unpredictable business, which is why we offer our clients a variety of loan options that are designed to meet their specific needs.

Our experienced loan officers will work with you to develop a financing plan tailored to your unique situation, ensuring that you have the support you need to succeed and grow your business.

We can help you acquire agricultural financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

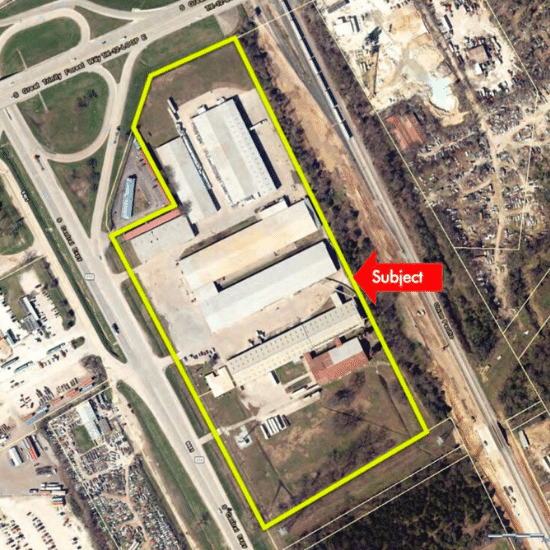

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com