If you believe you have found the perfect site for a building in Florida, or if you believe a piece of land will appreciate over time, you must look into innovative private land financing options. Acquiring knowledge regarding land loans in Florida can lead to numerous development and investment prospects.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Type of Land Loans in Florida

Land equity loans – They use the equity in existing properties to give investors flexibility and convenience when financing land investments.

Private Land Loans – If you’re an investor trying to close deals quickly, local private lending groups can provide you with fast financing options like bridge or hard money loans.

SBA 504 Loans – These loans, which the US Small Business Administration manages, facilitate the purchase and renovation of existing commercial real estate.

Seller Financing – This unique arrangement eliminates the need for traditional mortgage lenders by having buyers pay the land seller directly in installments.

USDA Rural House Site Loans – Designed for low- to moderate-income families, these loans support the purchase and development of rural house sites.

Agriculture Loans in Florida

Florida provides funding for a range of agricultural endeavors, including business startups, farmland expansion, and rural property acquisition. Agriculture loans in Florida offer equipment, real estate, crop cultivation, and infrastructure, all supporting profitable farming ventures and long-term growth.

Contact Us to Know more about Florida Land Loans

Several factors, including loan types, lender regulations, and intended land use, must be carefully taken into account when navigating Florida land loans. Consulting with knowledgeable professionals can help you make well-informed investment decisions. To find out more about affordable residential land financing options tailored for Florida investors, contact private capital investors right now.

Get In Touch

Our Loan Programs

Agricultural Land Loans

Our loans help farmers purchase land and create successful, thriving farming businesses.

Land Loans

Land loans offer specialized financing to simplify the purchase of undeveloped land.

Commercial Bridge Loan

Bridge loans are vital for CRE investors needing upfront capital without permanent financing. Get yours in 14 days!

Farm Credit Loans

Farm Credit Loans for land boost productivity, profitability, and ensure long-term farm success.

Commercial Stated Income Loan

Get low-document commercial real estate loans fast with no tax returns or W-2s required.

Commercial Hard Money Loan

We offers fast hard money loans for commercial properties ($1M to $50M) with rapid approvals.

Why choose Private

Capital Investors?

We understand that farming can be a challenging and unpredictable business, which is why we offer our clients a variety of loan options that are designed to meet their specific needs.

Our experienced loan officers will work with you to develop a financing plan tailored to your unique situation, ensuring that you have the support you need to succeed and grow your business.

We can help you acquire agricultural financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

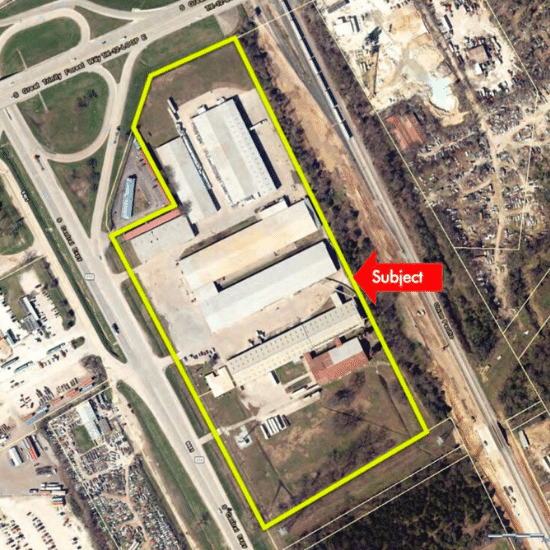

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com