Did you know that there are over 6 trillion US dollars in the unrealized capital gains in all of the United States put together? Well, now you know.

That’s a massive number and it opens up a whole new set of opportunities for people who are looking to actively invest their money into high-profit investments.

But what does it mean to have over 6 trillion US dollars in the unrealized capital gains for commercial real estate investors?

It means that the potential market for reinvestment in the real estate sector for commercial real estate investors is absolutely massive!

Whilst many investors are only limiting their views on the most popular types of commercial real estate investing, the few that are truly paying attention to the unrealized capital gains might make huge profits as there’s less competition here and quite honestly, the commercial real estate market in the unrealized capital gains sector is unsaturated.

Or, at least, yet to be ‘saturated’. So, before it becomes saturated too, it’s better you look into how you can capitalize on this massive opportunity.

This blog outlines all you need to know about the opportunity zones, why investing in opportunity zones is a great idea for you and how you can invest in opportunity zones. Hang in tight there.

What are Opportunity Zones?

Opportunity zones are census tracts that are usually composed of economically distressed communities, which qualify for the Opportunity Zones Program and satisfies all the qualifications specified under the Tax Cuts and Jobs Act passed in the year 2017.

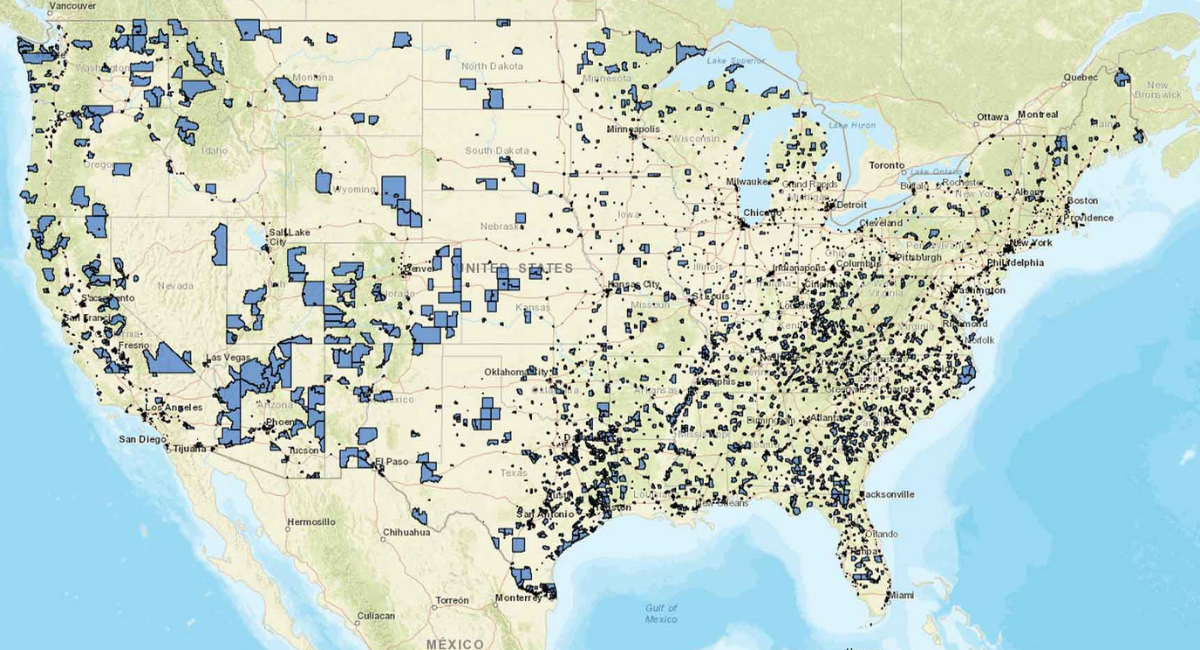

The law was passed with the goal of uplifting the economically distressed communities of the United States and ever since the law has been passed, Opportunity Zones have been designated throughout the US, including all the 50 states of United States of America, the District of Columbia, and the 5 US possessions which are – Guam, Peurto Rico, Northern Mariana Islands, American Samoa, and the Virgin Islands.

There are numerous opportunity zones in the 5 US possessions and in fact, all of Peurto Rico falls into opportunity zone.

Bottom line: there are more opportunity zones out there than one may think, sitting behind a computer screen and to real estate investors, this could mean a massive opportunity to not only capitalize on this huge investment opportunity but also to defer or decrease their own tax liabilities towards the massive capital gains gained.

What areas qualify for becoming an Opportunity Zone?

In order to qualify to become an Opportunity Zone, there must be at least 25% of low-income neighborhoods in a state, territory or districts.

This 25 % of low-income neighborhoods must meet the low-income qualifications set out clearly in the 2017 Tax Cuts and Jobs Act.

This can further be extended to up to 5% of non-low-income neighborhoods but where they’re meeting other geographic and income qualifications. The end goal of the 2017’s Act is to uplift the distressed communities in the rural and suburban parts of the United States.

Till date, there are more than 8700 qualified opportunity zones in the US and the US territories. Areas, thus certified as opportunity zones will go on to retain their designation for 10 years.

How to Invest in Opportunity Zones?

As an investor, your next big question will be – how do I invest in an Opportunity Zone? Here’s all you need to know about how investing in opportunity zones works for real:

As stated earlier, the designation of the opportunity zones in the first place is done to help spur the economic development of the distressed communities and the end goal always strictly remains to encourage investors who want to invest in these zones, and help these communities come up.

Now, that doesn’t mean, it is any kind of charitable or philanthropic work that the government is expecting commercial real estate investors.

The investors have got their interests guarded when it comes to investing in opportunity zones. So, what’s in it for a commercial real estate investor to invest in opportunity zones?

Well, to begin within exchange for investing in opportunity zones, real estate investors enjoy capital gains tax incentives which are available exclusively through the Opportunity Zones Program.

To get access to these tax benefits, the investors must invest in Opportunity Zones specifically through Opportunity Funds (OFs).

What are Opportunity Funds?

A qualified Opportunity Fund is either a US partnership or an association or corporation that intends to invest at least 90% of its total holdings into the opportunity zones.

In other words, these Opportunity Funds operate as private entities that work as a US partnership or a corporation, whose goal is to strictly dedicate a minimum of 90% of the total holdings towards investing in Opportunity Zones.

These Opportunity Funds are governed by the rules laid in the IRC section 1400Z-2. The Opportunity Funds can self-certify to the IRS by following simple procedures laid out clearly in the IRS section.

Besides, the onus of carrying out all the activities of an Opportunity Fund and to strictly ensure that they adhere to and abide by the guidelines laid out in the Opportunity Program is on the Opportunity Funds.

What does that mean to you as a commercial real estate investor? It means that you have to be very cautious with the qualified opportunity Fund you choose to work with for one big reason – should they default in keeping up with the guidelines laid out in the Opportunity Program, your funds and investments might go for a toss.

So, it’s always recommended to conduct due research before you finalize on the Opportunity Fund you want to work with to safeguard your best interests.

What are some of the types of investments an Opportunity Fund can invest in?

Since the whole purpose of Opportunity Zones is to uplift the economically distressed communities in the US, there are certain restrictions on areas an Opportunity Fund can apply or direct its funds.

They cannot invest in ANY opportunity blindly and must strictly abide by the laws laid out in the Act. The types of investments where Opportunity Fund can invest in are called “Qualified Opportunity Zones Property” which can be any one of the following 3 types:

Number 1 – Stock ownership in the commercial businesses which conducts the majority of all of their operations within a qualified opportunity zone identified by the government

Number 2 – Being a partner in businesses that operate in a qualified Opportunity Zone

Number 3 – Properties, that is real estate which is located in a Qualified Opportunity Zone

Now, again moving further rules and strict guidelines on how each of these three investment options is carried out individually.

Before jumping in to invest in any of the three types of investment options available to you, you should thus first understand all the rules and regulations that govern these types of investments – and then, carefully weigh your costs and benefits with regards to each type of investment.

Making an informed decision is crucial in determining whether or not you’ll be able to fully capitalize on this massive opportunity.

What are the advantages of investing in Opportunity Zones?

In exchange for investing in the Opportunity Zones and complying all the rules laid out in the Opportunity Zones Program, the investors become eligible to access substantial capital gain tax incentives, both immediately (coming to effect soon after the investment has been initiated) and in the long term.

Here’s how it works:

When an investor divests his investment which has been appreciated over time, say real estate property or stocks, they realize profits which are called “Capital Gains”, which amounts to a taxable event.

Now, in all other cases, the investor is expected to file capital gains tax returns on this taxable gain. However, should the investor choose to reinvest the proceeds of this capital gain into an Opportunity Zone, they can defer and further reduce their tax liability on that capital gain.

Beyond this, investors can receive tax-free treatment on all the future appreciation earned through the Opportunity Fund. Here’s the break-up of tax incentives:

- Investors who reinvest capital gains into an Opportunity Fund can defer the payment of tax on that capital gain until April 2027. In order to qualify for this – the investment needs to be done within 180 days of realizing a capital gain.

- Those who hold their investments in Opportunity Fund for at least 5 years prior to December 31, 2026, can further reduce their tax liability on the deferred original capital gain principal by 10%.

- If an investor further holds his investments in Opportunity Fund for at least 7 years prior to December 31, 2026, he can further reduce the tax liability on the deferred original capital gain principal by 15%.

- Further, those who hold their investments in the qualified Opportunity Fund for more than 10 years, can enjoy tax-free treatment on all the further appreciation their Opportunity Fund investment makes.

These are the main tax benefits can investor can enjoy by choosing to invest in Opportunity Zones. Moreover, commercial real estate investors are also interested in the further appreciation on the properties bought in Opportunity Zones with an added benefit of tax-free capital gain, making it all the easier to hold on for long periods of time with an intention of selling later.

Conducting solid research and making a wise and informed decision to create a portfolio of Opportunity Zones investments is your best bet to increased your opportunity to capitalize on the laws laid out in the 2017 Act.