Commercial Real Estate

Hard Money Loan Lender

Private Capital Investors provides the best hard money loan lending solutions. We finance commercial properties $1 million to $50 million and close as fast as 2 weeks. Approvals within 24-48 hours.

10000+

Loans

150+

Clients

$100M+

Funded Loans

Commercial Hard Money Loan Lender

Private Capital Investors is a full-service commercial direct Lender for hard money loans and bridge loans with correspondent relationships with Life Companies, CMBS, as well as Pension Funds, which enables Private Capital Investor to offer permanent financing as well. We have been able to offer these services since 2001.

Being a direct commercial real estate hard money lender, you get the funding quickly, so you can take advantage of an opportunity before it disappears.

Flexibility and speed are the main advantages of hard money loans, making them ideal if you require financing that focuses on an asset or purchases another investment property. In addition, being the direct commercial hard money lenders, we have a quick application process, less documentation required, and fast closing.

Funds allocation within 2 weeks

Loan Amount: $1 Million to $50 Million

LTV up to 85% LTV

Interest Rates as low as 7.59%

Lending Areas: nationwide

Eligible Commercial Properties

Multi-Family

Retail

Luxury Residential

Urban Land

Development

Eligible Transactions

Purchase loans

Why choose Private

Capital Investors?

Did your bank say “no” to your project? Is your credit less than stellar? Or perhaps your finances are not quite in order? Regardless of your situation, Private Capital Investors can help. With our experience team of commercial real estate hard money lenders in Houston and Dallas, we’re confident in our ability to connect you with the right financing solution that suits your needs.

Many investors have the wrong idea about hard money loans. That’s we walk you through the process and help you find the right hard money lending solution.

Rates as low as 7.59%

Nationwide Lending

24 – 48 Hours Approvals

Funding as little as 14 days

Stated Incomes, No Financials required

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

Refinance 2800 Farm

Fergus County, MT | $8,700,000

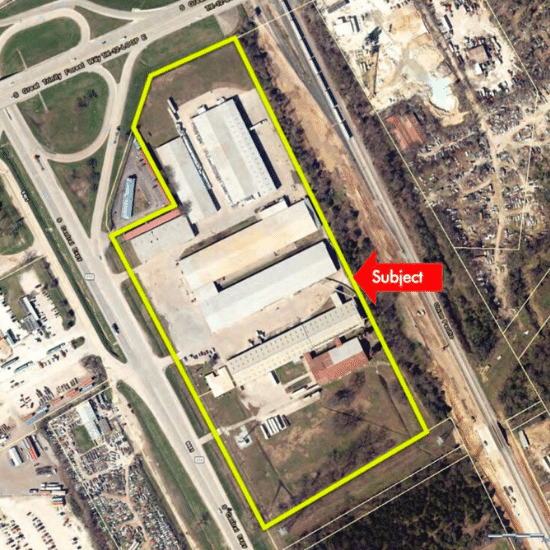

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Commercial Hard Money Loans With Private Capital Investors

Commercial Real Estate Hard Money Loans

For investors who require quick access to capital, commercial hard money lending offers a flexible financing option.

These loans are based mainly on the value and potential of the property itself, rather than on borrower credit scores or excessive amounts of financial documentation.

When traditional banks are unable to meet their deadlines or funding requirements, many borrowers turn to commercial real estate hard money lenders because of their asset-driven approach.

How commercial hard money loans work

These loans are short — measured in months, not years. They have interest-only payments and a lump-sum payoff at the end. As direct CRE hard money lenders, we care more about the property, not the borrower.

Why Private Lenders Approve Faster?

To avoid lengthy bank committee evaluations and layers of paperwork, private commercial lenders who make hard money loans often provide direct funding.

Due diligence expenses are usually not required up front, and many lenders handle all underwriting internally.

As such, commercial real estate hard money lenders are the best option for complex or urgent transactions, as approvals and closings can occur much more quickly than with standard lenders.

When completing a transaction requires speed, flexibility, or deal originality, these loans by Private Capital Investors offers a practical solution.

Frequently Asked Questions

What is a commercial hard money loan?

These are privately-funded short-term loans secured by commercial property, usually sized around the asset and the exit plan.

How hard is it to get a hard money loan?

As lenders prioritize property value above borrower credit or tax verification, approval is typically quicker and more flexible.

Do hard money lenders need a down payment?

On a purchase, yes in most cases. Hard money lenders rarely finance 100% of the price. You will typically need to bring cash equity.

What percentage do hard money lenders charge?

Pricing varies by deal risk and leverage. Most hard money pricing includes an interest rate plus lender fees (often “points”). Higher risk deals are priced higher.

How long do you have to pay back a hard money lender?

Usually, a few months up to a couple of years (6 to 24 months)

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com