Land Equity Loans

Land Equity Loans are for landowners expecting to use the equity in their property to finance major projects, build a house, or reduce debt. With the appropriate lending solutions, we can help you reach your financial goals.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Land Equity Loan Lenders

Land Equity Loans can provide the required funding, whether you’re planning significant changes or need access to cash for other ventures.

A land equity loan lets you tap the appraised value locked in your acreage—using the land itself as collateral—to fund construction, consolidate debt, invest in new property, or cover large expenses without giving up ownership.

By turning idle equity into strategic capital, a land equity loan boosts cash flow, and strengthens long‑term financial growth.

While some lenders may provide flexible repayment arrangements, others offer larger loan-to-value ratios.

Working with lenders who understand the unique land ownership requirements and can customize their loan offerings to match your requirements is essential.

Private Capital Investors works with a network of respectable Land Equity Loan lenders to give you the best choices.

Land Equity Loan Parameters

Amortization: 30 years amortization with no prepayment penalties

Loan Amount: $3 Millions to $50 Million

Needs Min Credit Score: 680

Closing in as little as 2 weeks

Maximum LTV: Upto 70% Loan to Value

Adjustable and Fexible rates

Nationwide Lending

Eligible Transaction Types

Opportunity purchases

Quick closings

Full-time agricultural activities

Part-time agricultural activities

Purchase new farms

Expand existing farm land

Traditional acquisitions

Invest in such recreational activities as fishing,

Short Lines of Credit

Eligible Land or Farm Loans Types

Alternate Ag Loans

Hobby Farm Loans

Cattle Loans

Orchard Loans

Poultry Farm Loans

Cirtrus Loans

Vacant Land

Rural Land

Agriculture Operation loan

Why Choose Private Capital Investors

If you’re considering taking advantage of your land’s equity, acquiring professional guidance specific to your situation is crucial.

Our seasoned financial specialists are ready to guide you through every nuance of land‑equity financing—from structuring the loan to navigating the relevant regulations and legal framework for land equity loans. With lending solutions tailored to your goals, we’ll help you unlock the capital you need, whether you’re developing your acreage or funding another venture.

We do offer other commercial real estate loan programs as well to cater your overall financial needs. Our loan:

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Min. Credit Score: 680

Excellent Customer Service

Common Sense Underwriting

Land Equity Loans – Pros and Cons

Pros

-

Leverage your land’s built‑up value – unlock cash without selling the property, using the equity you already own.

-

Potentially lower interest rates than personal loans – because the land serves as collateral, rates can be more favorable than unsecured borrowing.

-

Large loan amounts – high loan‑to‑value (LTV) ratios let you access substantial capital for construction, debt consolidation, or investment.

-

Credit‑challenged borrowers may still qualify – strong equity and a solid appraisal can offset less‑than‑perfect credit scores, though rates will be higher. This can be a good option for individuals who are seeking a Land loan with bad credit.

Cons

-

Risk of foreclosure – defaulting puts your land at stake, because the property secures the loan.

-

Higher rates for bad credit – lenders typically raise interest and fees if your credit history shows late payments or high utilization.

-

Property appraisal hurdles – uncommon or rural parcels can be hard to value, leading to lower approved amounts or denial.

-

Limited lender pool – fewer financial institutions specialize in land equity loans, reducing options.

We Serve Nationwide

Our Recent Closings

Christian College

San Diego | $13,000,000

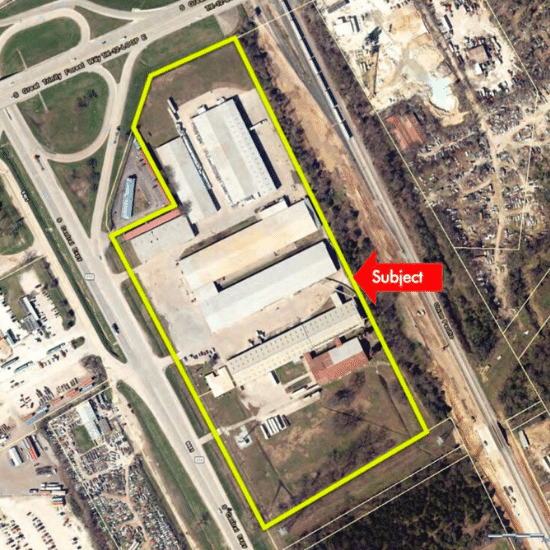

Light Industrial Warehouse

Dallas TX | $7,500,000

Office/Industrial

Leander TX | $7,200,000

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com