Operation Loans

An operation loan is intended to assist with the daily operations of companies, especially those in manufacturing and agriculture.

1500+

Loans

1500+

Clients

1500+

Funded Loans

Why is an Operation Loan Needed in Agriculture?

The type of operation loans is what gives them adaptability. These loans, which come in lines of credit with flexible withdrawal terms and term loans with an upfront lump sum and set payback schedules, can be customized to meet various business needs.

The operational needs and unique financial status of your company will determine the best kind of operation loan. Depending on the borrower’s creditworthiness and the lender’s requirements, a loan may be unsecured or secured by collateral.

Using an Operation Loan, companies may ensure that short-term financial debts are satisfied without interfering with their long-term growth goals by keeping liquidity and stability throughout the year.

Amortization: 30 years amortization with no prepayment penalties

Loan Amount: $3 Millions to $50 Million

Min Credit Score: 680

Closing in as little as 2 weeks

Maximum LTV: Upto 70% Loan to Value

Adjustable and Fexible rates are available

Nationwide Lending

Eligible Transaction Types

Opportunity purchases

Quick closings

Full-time agricultural activities

Part-time agricultural activities

Purchase new farms

Expand existing farm land

Traditional acquisitions

Invest in such recreational activities as fishing,

Short Lines of Credit

Eligible Land or Farm Loans Types

Alternate Ag Loans

Hobby Farm Loans

Cattle Loans

Orchard Loans

Poultry Farm Loans

Cirtrus Loans

Vacant Land

Rural Land

Agriculture Operation loan

Contact Us to Know More About Operation Loan

Any business operation has to understand the proper financial structure in order to be successful.

Our staff at Private Capital Investors is here to help you if you’re thinking about applying for an operation loan or if you need more precise details on how these loans may be tailored to meet your unique requirements.

We offer professional guidance and customized finance options to assist you in overcoming your operating difficulties.

Get in touch with us right now to find out how an operation loan might help your company meet its present and future needs.

We can help you acquire operation financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Rates as low as 7%

Nationwide Lending

Quick Approvals

Funding as little as 14 days

Min. Credit Score: 680

Excellent Customer Service

Common Sense Underwriting

We Serve Nationwide

Our Recent Closings

Christian College

San Diego | $13,000,000

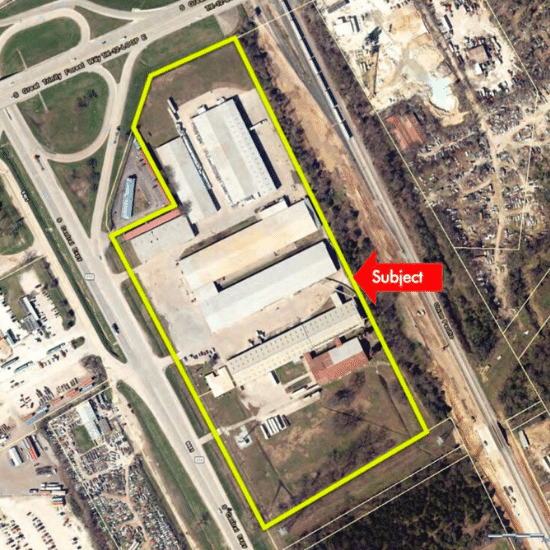

Light Industrial Warehouse

Dallas TX | $7,500,000

Office/Industrial

Leander TX | $7,200,000

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com