Commercial Real Estate Bridge Loan Financing

Commercial real estate bridge loans are a financial tool for CRE investors who need more money upfront but don’t have permanent financing yet. We being the direct lender help you get the loan within 14 days.

800+

Loans

250+

Clients

$10B+

Funded Loans

Commercial Bridge Loans

The ‘bridge’ name comes from how these instruments can help smooth out cash flow during difficult times by providing quick access to liquidity without having any serious consequences.

Bridge loans are widely used for repositioning, value-add, or rehabilitation opportunities. It’s important to secure this financing from trusted commercial real estate bridge loan lenders so you can get the best rates and terms.

Commercial real estate bridge loans can help investors prevent liquidity issues. They are perfect for vacant buildings, special purpose properties and major rehabs. Private Capital Investors, being a direct commercial real estate bridge loan lenders can allocate funds quick and fast.

Loan upto $50 million

Loan term ranging from 1 to 3 years

1.25 at exit with appropriate in-place DSCR

Maximum LTV: 85%

Interest Rate as low as 5.99%

First mortgage lien on the subject property as securtiy

Tax & Insurance Escrows: monthly

Replacement Reserves: monthly

Standard Requirements

- Property address + property type

- Purchase price (or current value) and requested loan amount

- Your timeline to close

- Current rent roll (if the property has tenants)

- Quick income/expense summary

- Business plan

- Exit plan (refi/sale) + target timing

- Recent bank statement(s) showing funds to close/reserves

Standard Closing Costs

2% to 4% of the loan amount

Eligible Transaction Types

Opportunity purchases

Quick closings

Non-stabilized properties

Foreign nationals

Non-cash flowing properties

Foreclosure purchases

Traditional acquisitions

Acquisitions with rehab component

Acquisitions with completed new construction

Debt buy-backs with fresh equity

Properties in lease-up in strong markets

Eligible Property Types

Multi-Family

Office

Retail

Luxury Residential

Urban Land

Self-Storage

Light Industrial

Hospitality

Development

Mixed-use property

Our Recent Closings

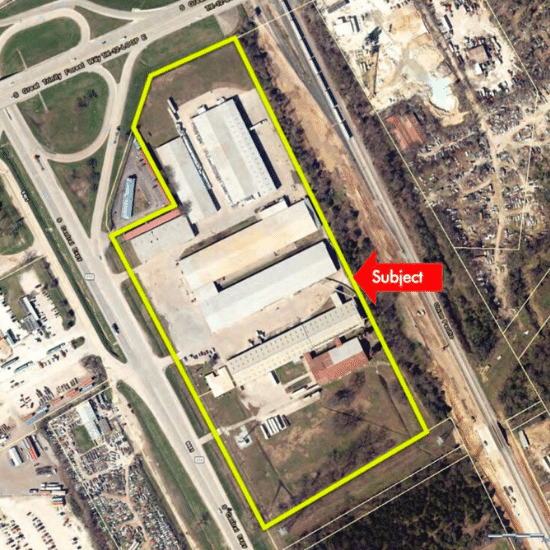

Refinance 2800 Farm

Fergus County, MT | $8,700,000

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Why choose Private

Capital Investors?

We are one of the trusted direct commercial real estate bridge loan lenders.

Our team of experienced CRE professionals will analyze your financing needs, so you can make informed choices.

We can help you acquire bridge financing in different cities and states, such as Miami, Florida, Denver, Massachusetts, Phoenix, and Texas.

Our loan offers:

Rates as low as 5.99%

Nationwide Lending

24 – 48 Hours Approvals

Funding as little as 14 days

Stated Incomes, No Financials required

Excellent Customer Service

Common Sense Underwriting

When Might You Need a Bridge Loan?

Buy quickly before another buyer wins the deal.

Hold a property that is not yet fully leased.

Renovate or reposition.

Acquire distressed or poorly managed CRE.

Refinance as a previous loan expires.

Pull cash out to reinvest elsewhere.

Why Choose a Private Lender vs. a Bank for CRE Bridge Loans?

What is a Bridge Loan & How Does It Work?

A bridge loan is short-term financing that covers the gap until you lock in permanent debt or sell/refinance the property.

In CRE, it’s commonly asset-based, with the lender sizing the loan around value, equity, and the exit plan, then you repay with a sale or takeout refinance.

Most bridge loans run 6 months to ~3 years, often with interest-only payments and a balloon payoff at maturity.

Benefits of Bridge Loan for Commercial Properties

- Speed when a seller’s deadline won’t wait for bank timelines

- Works during transition

- Flexible: Stabilize first, then refinance into longer-term debt

Types of Commercial Bridge Loans for Investment Properties

- Acquisition Bridge Loan so you can buy now, refinance later once stabilized

- Refinance Bridge Loan so you can replace a maturing loan and buy time to execute a plan

- Value-add/Rehab Bridge Loans so you can fund improvements and lease-up

How to qualify for a commercial bridge loan

- Prepare:

- Enough equity (~65–80% LTV, sometimes higher on strong deals)

- Exit plan with a realistic timeline

Bridge Loan Interest Rates & Terms

- Interest rate: as low as 5.99%

- Loan term: 1 to 3 years

- Maximum LTV: 85%

- Loan size: up to $50 million

Check Our CRE Bridge Lending Blogs

Pros and Cons of Commercial Bridge Loans

Pros and Cons of Using Bridge Loans for Commercial Property Investment [ninja_tables...

Bridge Loan Explained: Fast Financing for Commercial Real Estate Investors

Most CRE investors have experienced this situation: You’ve got a deal in front of you but your...

4 Key Factors Commercial Investors Should Consider Before Opting for a Bridge Loan

Commercial real estate moves fast — and CRE investors don’t always have time to wait on...

Frequently Asked Questions

Who is a CRE bridge lender?

A bridge lender in the CRE space gives short-term loans backed by commercial real estate, with the expectation that the loan will be repaid soon, usually through selling the property or refinancing with a long-term loan.

Is it hard to get a bridge loan to buy a commercial property?

Usually easier than a bank loan on a transitional asset. But you still need equity and a believable exit plan.

Who qualifies for a bridge loan?

Borrowers with sufficient equity and a workable plan to stabilize/improve the asset

Do I need a down payment for a bridge loan?

On purchases, typically yes — bridge lenders rarely finance 100% of the price. Common leverage is often around 65–80% LTV.

What is the current interest rate for a bridge loan?

There isn’t one single “current” rate. Rates change based on how much you’re borrowing (leverage) and the state of the property (stabilized or not). It can also change based on how risky your exit plan is.

How quickly can you get a bridge loan?

We can close and release funding in as fast as 14 days.

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com