Private Commercial Real Estate Lenders Program for Commercial Investors

Private Capital Investors prides itself on being able to provide the best commercial real estate loans for our borrowers. Being direct private commercial lender, we fund commercial properties from $2 million to $50 million and are able to provide approval within 24-48 hours.

10000+

Loans

150+

Clients

$100M

Funded Loans

Our Commercial Real Estate Loans Program unlocks rapid capital for acquisitions, construction, and refinancing.

We are experienced private commercial real estate lenders and our terms fits your project’s unique needs.

We offer competitive rates and streamlined underwriting mean you can close the deal quickly and stay ahead of market shifts.

From mid‑market deals to large expansions, we empower investors to maximize returns with confidence.

Our Commercial Property Financing Program Also Offers

Hard Money Loan

We’re direct hard money lenders and we know how to finance your next commercial real estate deal. Being a direct lender, we provide fast, flexible, and easy to get loans.

Commercial Bridge Financing

Bridge loan financing can provide much-needed liquidity, and it can be a great option for investors that don’t have the time or resources to go through the traditional lending process.

Stated Income Loan

We have created our stated income loan for commercial real estate investors who find it difficult to get traditional loans. As a direct private lender, we provide CRE loans with minimum documents.

Why Choose Private

Capital Investors?

We are direct private commercial real estate lenders and help you get loans quickly and easily from the wide array of commercial real estate loan programs.

We are committed to helping all kinds of commercial property investors find the most suitable funding solution at the best rates.

Though we are based in Dallas, but we work as private commercial lender of CRE loan programs beyond Dallas and Houston. We serve clients nationwide which including Miami, Pheonix , Florida and many more.

Our loans have

Rates as low as 7.59%

Nationwide Lending

24 – 48 Hours Approvals

Funding as little as 14 days

Stated Incomes, No Financials required

Excellent Customer Service

Common Sense Underwriting

Our Recent Closings

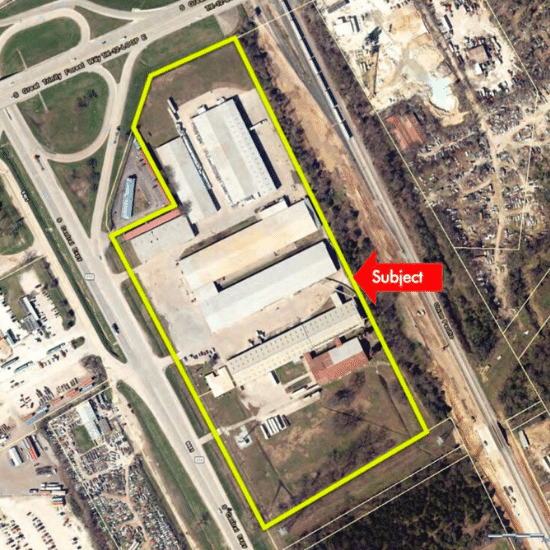

Refinance 2800 Farm

Fergus County, MT | $8,700,000

Office/Industrial

Leander TX | $7,200,000

Light Industrial Warehouse

Dallas TX | $7,500,000

Why You Can Rely on Our Private Commercial Real Estate Loan & Financing Expertise

Overview of Private Commercial Real Estate Lending

For both companies and investors, investing in commercial real estate can change everything.

Commercial property loans provide you with the financial flexibility you need to accomplish your objectives, whether you’re growing your company, renting office space, or investing in retail stores.

These loans enable our CRE investors to purchase valuable commercial real estate without exhausting their operational resources.

By working with a private commercial lender, you can maximize your investment potential and make well-informed selections by understanding the benefits of the appropriate loan type.

Major Types of CRE Loans We Offer

- Commercial Bridge Loan

- Commercial Hard Money Loan

- Commercial Stated Income Loans

Eligible Property Categories

Many different kinds of properties can be supported by private financing, such as:

- Industrial facilities

- Office buildings

- Multifamily communities

- Retail centers

- Self-storage complexes

Key Lending Advantages from a Private Lender

- Adaptable financing conditions based on the property, schedule, and investment objectives

- Relationship-based assistance with easy access to knowledgeable lenders

- Dependable performance, particularly when timing is crucial for refinancing or purchases

We Help You Choose the Right Loan

To match you with the best financing structure, our team assesses your exit strategy, property type, and investment objectives.

Whether you’re repositioning an asset or growing a portfolio, we also consider alternative funding options to ensure your capital stack serves you best.

CRE Lending Power Across the U.S.

No matter where your location is, we’re ready to help. As top-rated private commercial real estate lenders, we maintain partnerships with nationwide lenders to ensure you’re never limited by geography.

We serve nationwide, mainly serving across cities of Texas, Florida, Miami, Illinois, etc.

If a lender isn’t the right fit in your state, we quickly pivot to another in our network.

That’s the power of working with a private commercial lender with deep market connections and nationwide coverage.

Get Started with a Trusted Private Commercial Real Estate Lender

The application process is simple and designed with you in mind. From your first inquiry to final funding, our expert advisors guide you every step of the way. You’ll never feel lost or left out of the loop.

When you partner with Private Capital Investors, you get:

-

A dedicated team that understands the real estate market

-

Fast, hassle-free loan approvals

-

Flexible funding solutions from experienced private commercial real estate lenders

It’s time to stop waiting and start building. Let’s help you turn opportunity into reality.

Frequently Asked Questions

What are Private Commercial Lenders?

Individuals or businesses that offer finance outside of conventional banks are known as private lenders.

Many investors choose them as their preferred private commercial real estate lenders Private Capital Investors because they provide flexible underwriting and quicker approvals.

How Much Down Payment is Required for Commercial Property?

The majority of lenders require 20% to 30%, although this varies depending on the risk and loan arrangement.

Is it Better to go with Private Lender or Bank?

A private commercial lender is better if you need speed, flexible terms, or creative financing, while banks may offer lower rates but stricter requirements.

What are the current Interest Rates for CRE Loan?

There are some excellent rates for commercial real estate loans these days. Depending on the property type, interest rates are as low as 7.99%, with an LTV (loan-to-value) ratio of up to 75% of the property’s appraised value. You may even qualify for up to 80% if you are the owner-user.

How much funding can I get with Private Capital Investors?

There is no limit. On average, our lenders can provide loans of up to $5,000,000. But if you have a bigger project, let us know and we’ll design a funding solution for you. Our network of private commercial real estate lenders can provide funding for loan amounts that range from $1,000,000 to $50,000,000 and more.

What are the CRE Loan terms?

Flexible terms are available, from 3 to 10 years fixed, amortized upto 10 years.

What commercial property financing options do you offer?

We offer a wide range of financing options, including the following:

- Commercial Bridge Loans

- Stated Income Loans

- Commercial Hard Money

- Jumbo Hard Money

Will I qualify for a CRE loan?

CRE Loans are available for a wide range of commercial real estate investors—even for those with less than perfect credit.

As a Private Commercial Lender, we understand that your situation is unique. We’re confident that we have a loan that can help you access the money you require quickly and straightforwardly.

Contact us to tell us more about your project and find out what types of commercial real estate loans you may qualify for.

What locations does Private Capital Investors serve?

Private Capital Investors offers commercial real estate loan solutions throughout the United States.

We serve clients in all 50 states, including key markets such as Dallas, Houston, Denver, Phoenix, Boston, etc. Whether you’re investing in multifamily properties, retail developments, office buildings, or industrial sites, our flexible financing options are designed to support your project—regardless of location.

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com