Recent Closing

Private Capital Investors provides the best hard money loan with many different lending solutions. We can provide approvals within 24-48 hours for properties 1M to 50M and can fund within 14 days.

Closing: Refinance Office To Multifamily Conversion Pre-Development

Spokane, WA | $8,200,000

Closing: Refinance Medical Office Building

Plano, TX | $2,000,000

Closing: Office/Industrial – Purchase

Leander TX | $7,200,000

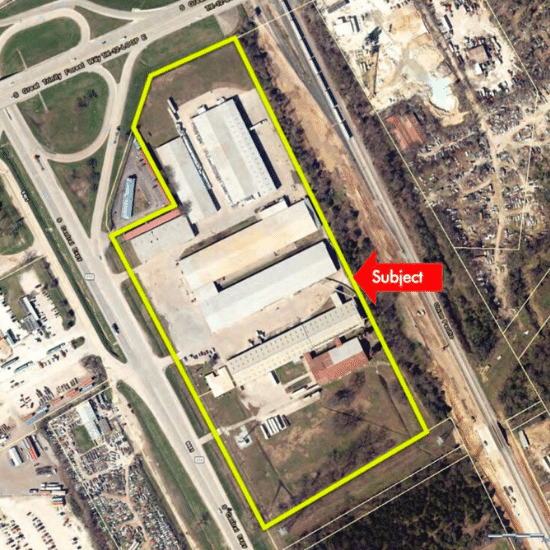

Closing: Light Industrial Warehouse – Purchase

Dallas TX | $7,500,000

Closing: SFR

Boca Raton, FL | $6,100,000

Closing: Land – Purchase

Manor, TX | $4,000,000

Closing: Christian College

San Diego | $13,000,000

Closing: Multi-Family – Cash-Out Refinance

Birmingham, AL | $4,450,000

Closing: Family Dollar Store – Purchase

Durham, NC | $1,200,000

Closing: Refinance 2800 Farm

Fergus County, MT | $8,700,000

Closing: Historic Retail Building Purchase

Memphis, TN | $2,900,000

Closing: ACE Hardware Store Conversion To Self-Storage Purchase

Kilauea Hawaii | $1,400,000

Closing: Strip Mall

Norcross, GA | $3,400,000

Closing: Multi-Family Refinance

Palm Beach, Fl | $2,400,000

Closing: Retail Shopping Center

Yuma AZ | $1,700,000

Permanent Financing 3.75% NO PREPAY. Walmart was the shadow anchor.

Some More Projects

Want to learn more? Get in touch with us today.

Our experienced team is ready to assist with your financing needs.

Address:

2101 Cedar Springs Road Suite 1050 Dallas, TX 75201

Phone:

972-865-6206

Email:

info@privatecapitalinvestors.com